Section 1071 Q&A post two

It seems that a banker will need to determine if the loan they are taking an application for is a HMDA loan, a CRA loan or Section 1071 loan. It is possible that a loan will be reportable for CRA…

It seems that a banker will need to determine if the loan they are taking an application for is a HMDA loan, a CRA loan or Section 1071 loan. It is possible that a loan will be reportable for CRA…

How can you report GAR as ‘not provided’ if you need to know this number in order to determine if it is reportable for Section 1071? It is my understanding that you do not have to verify GAR, so if…

The document is a Small Entity Compliance Guide for the Consumer Financial Protection Bureau’s Small Business Lending Rule, which requires financial institutions to compile and report certain data regarding business credit applications to the CFPB. The guide provides examples of…

Now that the Section 1071 rule is final, should we still be doing CRA Small Business as we do currently until we must begin the 1071 small business data collection based on the tier applicable to our loan volume? The…

We know that loans will be reportable for both CRA and 1071. What if we collect DemographicInformation and the loan ends up being reportable for CRA? Being reportable for CRA does notdisqualify a covered transaction from being reported under 1071.…

It is important for you to be aware that the term “small business,” as outlined in Section 1071, specifically refers to the Small Business Administration (SBA) Regulations Part 121. In order to comply with the Section 1071 and to better…

Presented by GeoDataVision in partnership with M&M Consulting Brace yourselves! On March 30th, the CFPB unleashed the long-awaited Dodd-Frank Section 1071 Rule, and it’s about to shake the finance world to its core. Thought the CRA data file was a…

On February 13, the ABA Banking Journal bore a headline, “Nichols: ABA won’t ‘sit idly by’, if regulators overstep their authority”. The article went on to cite examples of rule making and regulatory changes “that will do more harm than…

We all know that Climate-Related Risk regulations are in the process. The prudential bank regulators are not waiting for lawmakers to legislate climate risk law, they are actively drafting “guidance” and will be evaluating climate risk exposure as a “Safety…

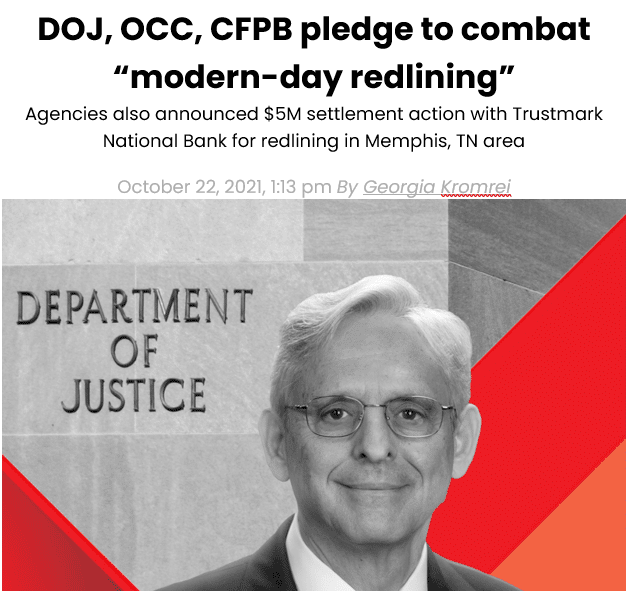

In emails in recent months we’ve warned bankers about the extremely aggressive enforcement of anti-redlining policies. This is becoming more and more obvious every day as more banks get threatened with referral to the DOJ. The word is the DOJ…

One of the most important CRA responsibilities for Intermediate-Small Banks and Large Banks is “Community Development Lending”. But while Community Development Lending is critically important, there is very little information available about the Community Development Loan Market. GeoDataVision has captured…

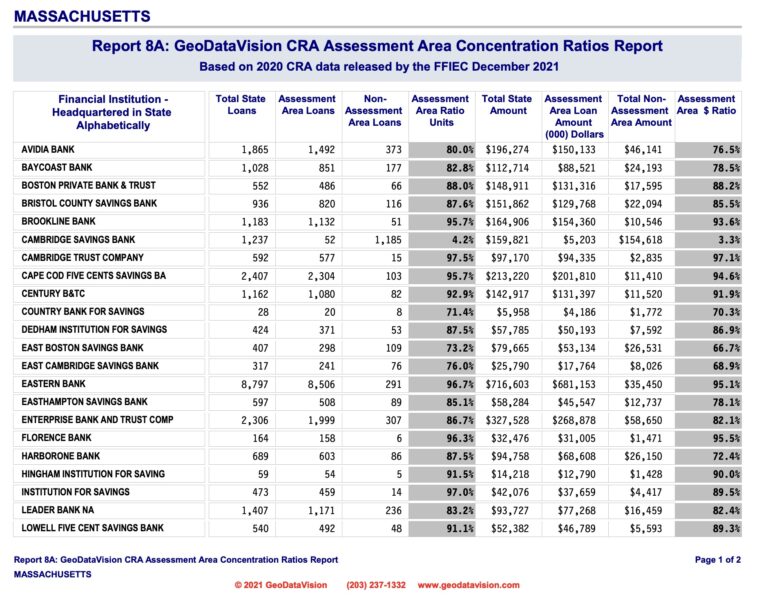

Dear Banker, Last year we learned that the Department of Justice Attorney General, Meritt Garland, announced an aggressive “Combatting Redlining Initiative.” At GeoDataVision we’ve observed the impact of this action on a growing number of community banks. However, what came…

Beware the Dramatic Implications for every bank! The effect of the switch-over from the census tracts for 2021 (based on the 2010 Census) and the 2022 tracts (based on the 2020 Census) cannot be overstated. Not only was there a…

Since the beginning of 2022, we’ve noticed an increasing number of community banks being pressured to expand their Assessment Areas and to annex nearby urban areas. There have been too many examples that we have seen for this to simply be…

Dear Banker, If the 2022 CRA NPR has you confused think again. Congresswoman Maxine Waters has just proposed legislation that makes the situation all the more confusing. Ms. Waters has just introduced a bill that would change the definition of…

One of the most important CRA responsibilities for Intermediate-Small Banks and Large Banks is “Community Development Lending”. But while Community Development Lending is critically important, there is very little information available about the Community Development Loan Market. GeoDataVision has captured…

GeoDataVision is pleased to announce the availability of free interactive Metropolitan Statistical Area Maps on the Internet. MSA’s are a very important factor in Assessment Area delineation for CRA purposes. The map can be used to pan across and zoom into any area within the United…

The Trident Mortgage redlining fine should be a reminder to compliance risk management officers about the Fair Lending pitfalls a lender can fall into. It is clear that the DOJ and the “Bureau” have marching orders that differ from that…

There are some signs that regulators are becoming aware of the major problems inherent in the 2022 CRA NPR and are starting to question the cost and benefits of the proposed Rule. In an August 6, speech before the Kansas Bankers…

The controversial 2022 CRA NPR comment period ended on Friday, August 5. While the proposed Rule does have some very good improvements in the Regulation, it also had some very serious, if not fatal, flaws. The NPR was long (679…