Tackling the Challenges of the New CRA Rule

American Bankers Association (ABA) Professional Certifications has approved New Rule CRA Webinar Series 2024 for:

7.25 CRCM, CERP credits.

3 - Part Education Series Followed by a recorded Q&A

in late March

Len Suzio

President GeoDataVision, CRA Expert & Presenter

Others contact jean@geodatavision.com

Dean Stockford

President M&M Consulting, Moderator

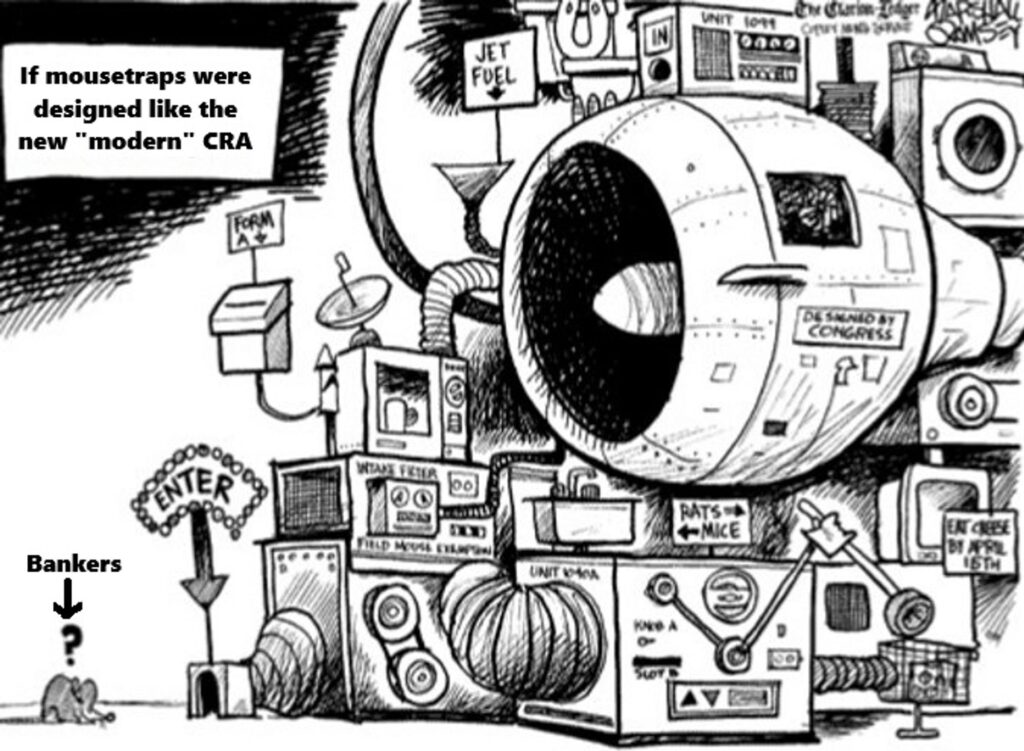

The new CRA rule, encompassing nearly 1,500 pages, introduces a level of complexity unprecedented in the industry. With a projected CRA exam failure rate increasing to ten times the historical norm, it's crucial for financial institutions to adapt swiftly. The complexity of the new Retail Lending Test and Community Development Financing Test cannot be overstated, demanding an in-depth understanding and strategic approach.

GeoDataVision's On-Demand Webinar Series: Your Guide to Mastery

In response, GeoDataVision is proud to present a comprehensive, 3-part on-demand webinar series. This 5-hour series, crafted by experts, is your key to mastering the new CRA rule.

Gain Expertise with Len Suzio

Guided by Len Suzio, a nationally renowned CRA expert with over 30 years in the field, these webinars offer an unrivaled exploration into the intricacies of the new CRA rule.

Series Highlights:

Part 1: Introduction to the new CRA Rule (approximately 2 hrs)

- What banks will be affected the most

- Important concepts in the new CRA - "Major Product Line", different types of "conclusions", "operating subsidiary"

- Traps within the new rule (AA delineation new requirements, the impact of operating subsidiaries, the April 1, 2024, effective date for section _.16 and the "applicability" dates for bank sizes)

- The general "architecture" of the new CRA

- The new Assessment Areas in the new rule

- Overlooked aspects of the new rule

- Different bank size categories

- Breakdown of the Retail Lending Test major components

- What to do to prepare for the new CRA rule

- The Transition rules

Part 2: the Retail Lending Test - Everything you want to know but are afraid to ask (approximately 2 hrs)

- What is the new Retail Lending Test?

- What loans are counted and how are they measured?

- What is the "Retail Lending Volume Screen"?

- What qualifies as a "major product line" in what kind of Retail Lending Test area?

- What are the "distribution" tests?

- What are the new calibrated benchmarks and how are they calculated?

- "Supporting conclusions, "Recommended" conclusions, and "Assigned Conclusions" -what's the difference?

- Formulas, formulas, and formulas

- Scores "translated" to conclusions and conclusions translated back to scores.

Part 3: The Community Finance Test, the Community Services Test, The Retail Products and Services Test (approximately 2 hrs)

- What is evaluated in the Retail Services and Products Test?

- What are the benchmarks in the Retail Services and Products Test?

- What "other considerations" affect your Retail Products and Services Test score?

- What is measured in the Community Development Services Test?

- How are community development services aggregated to the institution level?

- What is the new Community Development Financing Test?

- What's different between the new Community Financing Development Test compared to the current community development metrics?

- What are the benchmarks for the new Community Development Financing Test?

- What are the formulas for the new Community Development Financing Test?

** Plus bonus content. Recorded Q&A to be released in March.

Exclusive Offer - Register Now for Only $500! (For banks only. Others contact jean@geodatavision.com)

Get full access to the entire series. Equip yourself with the knowledge and tools needed to navigate the new CRA landscape confidently.

LEGAL NOTICE

The information and viewpoints presented in this video do not constitute legal advice and should not be taken as such. We recommend discussion regarding legal matters pertaining to the new CRA rule be done with a qualified attorney.

It is also important to note that the new rule contains several errors and a number of ambiguities that may be clarified by the regulators in the near future. In the meantime, this

presentation is based on a close reading of the new rule that may be subject to change as the new rule is put into effect.

If you experience any issues signing up please contact admin@geodatavision.com

© copyright 2024. All Rights Reserved