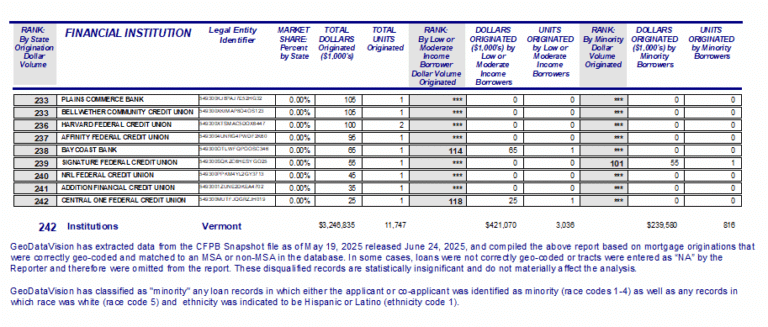

Free Market Share Reports for Small Business

The FFIEC released the official 2024 HMDA Aggregate & Disclosure file in June. GeoDataVision uses that data to create special market rank and market share reports for markets everywhere in the USA. This data is invaluable for CRA and Fair…