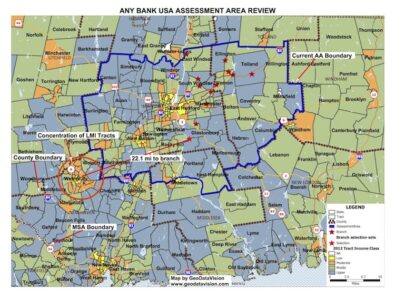

Fair Lending Products and Services

Fair Lending Risk Analysis Reports

These Reports provide a system for monitoring your Fair Lending by presenting statistical differences between Minority and non-Minority applicants within your mortgage portfolio and also identifying adverse outcomes between individual Minority records that were denied compared to non-Minority applicants, with similar credit characteristics but were approved. The reports may be summarized in a optional professional narrative that explains the individual reports, addresses the results, and offers comments and advice to help mitigate issues.

Minority Market Reports

These Reports allow you to compare your bank’s activity to all other reporting lenders in your market. Included are comparisons of:

- Minority denial rates

- Minority origination rates

- Minority market share

- Minority subgroup activity

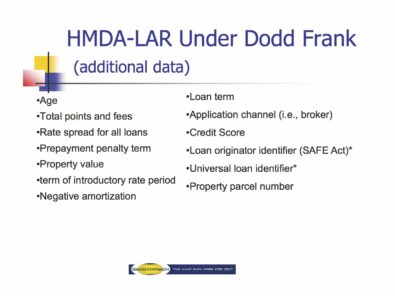

HMDA Mortgage Market Reports

Market Data extracted from the latest FFIEC National Reported HMDA, CRA, and Community Development. These Reports set the standards by which a bank will be examined. They expose the “performance context” information that can be supportive of a bank’s performance results. It is the information examiners will use to evaluate you.

Program Template

A GeoDataVision expert will work with you and your personnel in the areas of HMDA/Fair Lending/Risk Management. These services can be provided via the web or onsite, in person. In addition to hands on consulting and training, we also provide webinars (live and recorded) that are extremely useful in training your staff.

© copyright 2024. All Rights Reserved