Worried about how your bank may look under the new CRA Retail Lending Test? Check out the estimated performance benchmarks for your area

Every CRA officer is concerned about how their institution will fare under the new Retail Lending Test. The standards have been raised. Will your institution pass the test?

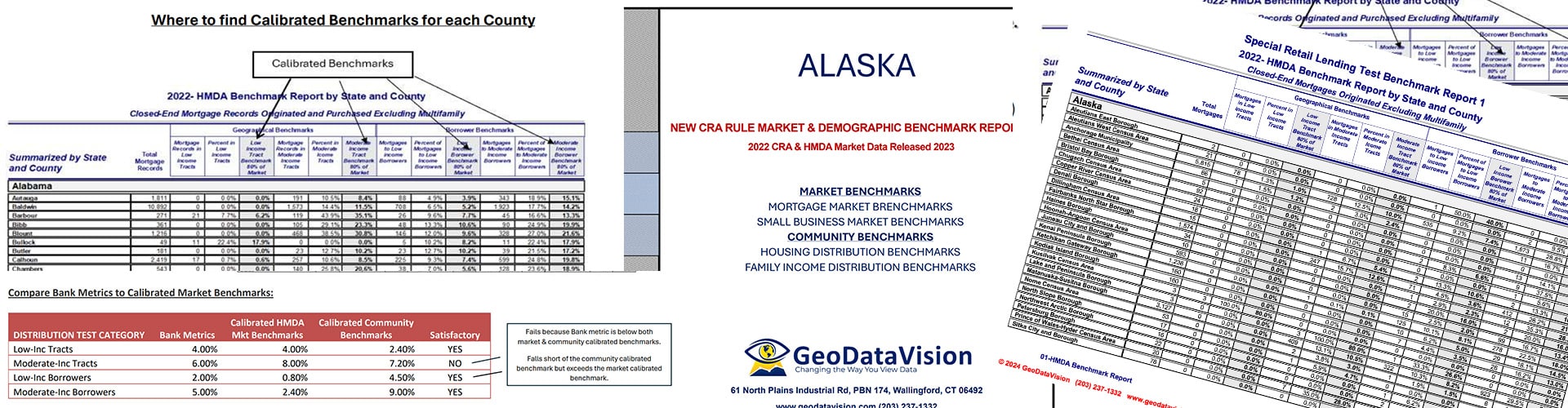

GeoDataVision has created a new report for every state that computes the "calibrated benchmarks" you would need to pass to earn at least a "satisfactory" performance rating. The calibrated benchmarks are based on the market (peer) and the community (demographic) standards that will be applied under the new Retail Lending Test.

Using the latest (2022) market and demographic data GeoDataVision has captured the relevant mortgage and small business market data for the as well as the owner-occupied housing and family income demographics that are the basis for the Retail Lending Test standards. GeoDataVision has applied the "multipliers" mandated by the new CRA to determine what the "calibrated" benchmarks would be for every county in the USA - the same methodology required by the new rule when the new test is implemented for 2026 activity.

With this data you can estimate how your institution will look under the new performance standards when they become effective the year after next. Gain valuable insight into the following questions and determine the all-important calibrated standards to attain at least a satisfactory "recommended conclusion".

- What is the mortgage market low-income tract penetration rate and what is the calibrated "satisfactory" standard in our FBAA?

- What is the mortgage market mod-income tract penetration rate and what is the calibrated "satisfactory" in our FBAA

- What is the small business loan market low-income tract penetration rate and what is the "satisfactory" calibrated standard in our FBAA?

- What is the small business loan market moderate-income tract penetration rate and what is the "satisfactory" calibrated standard in our FBAA?

- What is the distribution of families by income class in our market and what is the calibrated "satisfactory" standard?

- What is the distribution of loans to very small businesses and what is the calibrated "satisfactory" in our community?

- What is the distribution of owner-occupied housing by tract income class and what is the "satisfactory" calibrated standard in our market?

These special CRA Retail Lending Test Benchmarks Reports are available for only $250 per state and will include the calibrated benchmarks for every county that you need to get insight into how your institution may look when the new tests become effective in 2026.

Don't just wring your hands wondering how your bank may fare under the Retail Lending Test. Now you can get a valuable estimate of what the standards will be and how you will compare using historical data.

View Sample:

https://geodatavision.com/wp-content/uploads/2024/03/02-AK-BinderSpecialReports.pdf

Order your CRA Retail Lending Test Standards Estimation Reports today.

Contact Jean jean@geodatavision.com

© copyright 2024. All Rights Reserved