When the new CRA rule was published in late 2023 it contained some very serious flaws that need to be corrected. Fixing the flawed CRA rule should be a high priority for the Trump Administration because the new rule is scheduled to become “applicable” January 1, 2026.

So, what are the problems that are so serious they need to be corrected as soon as the new Administration can act? There are several serious problems, but none more egregious than the rules pertaining to so-called “assessment areas”.

When a bank is examined for compliance with the CRA regulations its performance is evaluated in what the regulation describes as the “performance context”, the facts and circumstances internal and external to the bank. In particular, examiners capture performance context in the form of demographic and credit market data that is included in “standardized tables” that contain the demographic and credit market data and the computed performance standards based on that data. Certain demographic variables and credit market activity are the basis for performance “benchmarks” used to rate a bank’s performance relative to its CRA responsibility to “meet the credit needs” of the community served.

It follows that critical demographic and credit market data are circumscribed by how the market, aka the “assessment area”, is delineated. Every market and every change to a delineated market changes not only a bank’s numbers, but it also changes the performance benchmarks used to rate a bank’s CRA performance. Changes in assessment area configuration can have profound consequences for a bank’s performance rating because any such changes affect the standards used to judge a bank’s performance. This is where the 2023 CRA rule is a disaster with consequences so enormous they demand a reconsideration of the prescriptions and proscriptions in the new CRA rule

Historically, assessment areas were always considered to be bound by the communities where a bank maintained its deposit-taking branches. In fact, banks were forbidden from designating assessment areas where a bank did not include deposit-taking branches. But the new “modern” CRA flips that requirement 180 degrees and adds new assessment areas called “Retail Lending Assessment Areas” that are outside the traditional branch-based markets. Moreover, as radical a change as the new Retail Lending Assessment Areas is, the new rule also adds a third market for evaluation, the “Outside Retail Lending Area”, or “ORLA”, which includes anywhere in the entire USA where a bank originated “major product line” loans that are not included in the traditional facility-based assessment area nor the retail lending assessment areas.

The ORLA can consist of any MSA where a bank originated a single major product line loan that was not included in the facility-based or the retail lending assessment areas. In other words, a New York based bank without any facilities in Los Angeles could be forced to include the Los Angeles MSA as part (called a “component geographic area”) of its ORLA and that single loan would be compared to the demographic and credit market benchmarks derived for the entire Los Angeles MSA. Any reasonable performance standards would consider these results as de minimis and not worth the bother to calculate. But the new CRA rule mandates their inclusion in a bank’s CRA performance rating. There literally could be dozens, even hundreds of such component geographic areas in a bank’s ORLA.

The new assessment area delineation rules in the “modern” CRA also have another serious flaw. They require banks that have $2 billion or more in assets to include nothing smaller than an entire county in their facility-based assessment areas. For nearly 50 years the legacy CRA has permitted banks to circumscribe their assessment areas based on the areas an institution can “reasonably be expected to serve”. That’s a practical and reasonable approach. But the new CRA now has adopted an arbitrary and capricious model that disregards this realistic approach.

It cannot be overstated that realistic and reliable CRA performance evaluations are based on realistic and practical markets. A rigid, inflexible rule that dictates unrealistic assessment areas will result in unreliable if not unreasonable performance ratings.

A good example can be seen in the Los Angeles market. During 2021, 99 banks operated 1,634 deposit-taking branches in LA. Of those banks, 8 “large” banks operated only 1 branch in LA County. There are now 2,498 census tracts in LA County. There’s no reasonable basis to believe a bank with 1 facility can be expected to serve the entire county of Los Angeles. This means all the performance calculations for those banks are going to be distorted and unrealistic, rendering the performance evaluation meaningless if not misleading. This is a direct contradiction of one of the major intentions of the new CRA rule, more objective and transparent performance evaluations. Not only that, but the performance scores are to be published under the new rule. So, while the “examiner in charge” may adjust the bank’s performance rating, the public will not understand why the “objective” calculated scores and “supporting performance conclusions” may not be consistent with the final performance ratings.

Finally, another serious flaw in the 2023 CRA rule that will undermine confidence in the legitimacy of CRA performance evaluations relates to the new Retail Lending Assessment Areas and the ORLA. The preamble to the 2023 CRA rule touts the “tailored” benchmarks that constitute the reference points for rating a bank’s performance. But a bank being evaluated for performance in the RLAAs and the ORLA suffers severe competitive disadvantages vis a vis lenders who maintain facilities within those markets. The “tailored” benchmarks make no adjustments for markets a thousand miles away from the closest branch of bank being examined competing with the local lenders in those distant markets. Once again, this undermines the legitimacy of the new performance rating system.

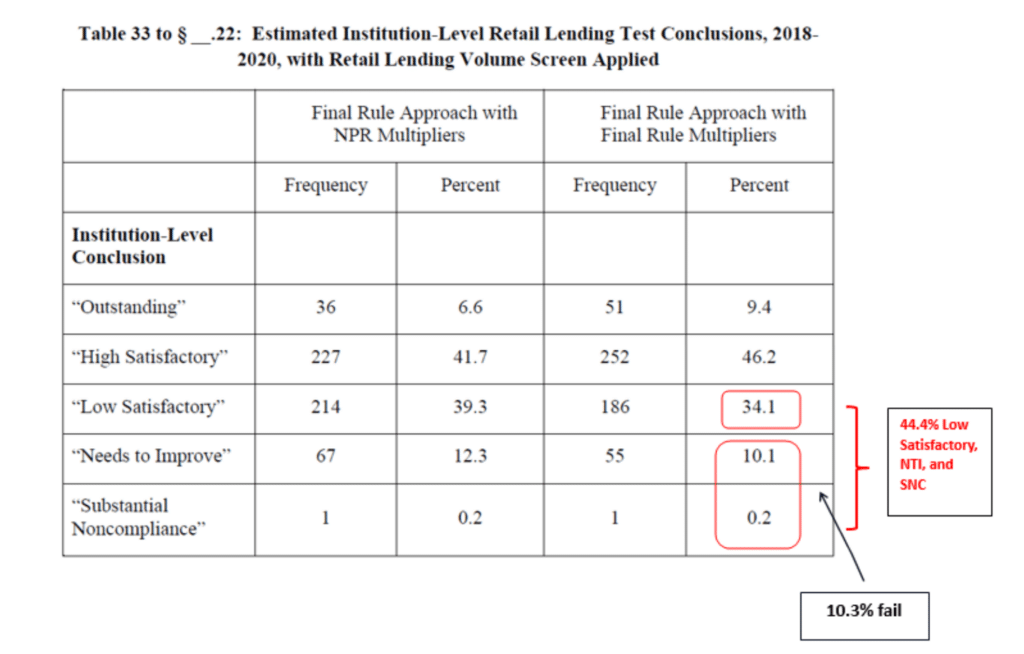

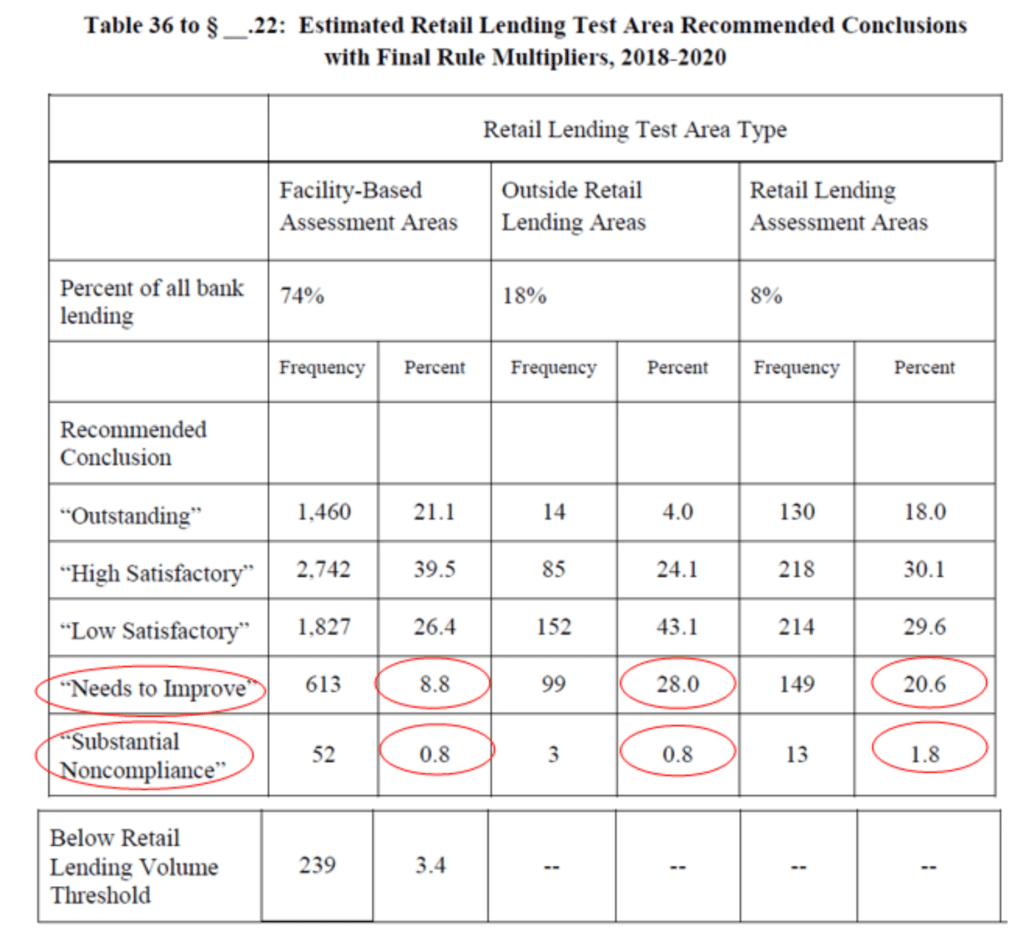

If there’s any doubt about the serious adverse consequences of the new assessment areas those doubts should be removed by the extraordinary high CRA exam failure rates as reported in the 2023 CRA preamble in tables 33 and 36 which show an imputed institution failure rate of 10.3% compared to an historical average of about 1.3% and much of that dramatic increase is evidenced by an imputed failure rate of 22.4% in the retail lending assessment areas and 28.8% in the ORLAs!

The flaws in the assessment area rules in the 2023 CRA rule are very serious and will undermine the confidence anyone can have in the performance ratings under the new rule. The Trump Administration should quickly rescind the 2023 rule and propose a new NPR or publish an NPR that proposes changing the assessment area rules section of the 2023 rule. The problems explained above are very serious and cannot be ignored.