In Parts I and II I explained the devastating impact of the new CRA Rule and what the underlying reasons for that adverse impact are. In Part III I will touch upon what banks are most significantly impacted by the new Rule.

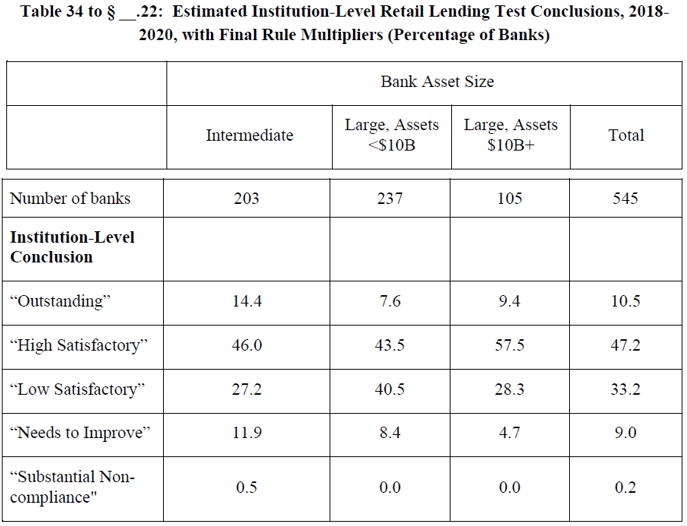

If you are wondering about who gets affected the most by the new CRA rule you don't have to look far. The answer can be found in Table 34 buried in the new Rule on pages 678-679. This table depicts the "Estimated Institution Level Retail Lending Test Conclusions" had the new Rule been in effect for exams during 2018 through 2020. The regulators developed this table to segment the impact of the new CRA Rule on Intermediate and Large banks broken out into 3 different size intervals.

The table clearly shows that Intermediate banks and all Large banks, less than $10 billion and $10 billion or more in size, will suffer much higher CRA exam failure rates than reflected in the historical experience (which has been about 1.2%).

Table 34 shows that Intermediate banks will endure the most radical impact with 12.4% of Intermediate banks getting a "Needs to Improve" or "Substantial Noncompliance" rating on the Retail Lending Test. At the same time, the Large banks from $2 billion to less than $10 billion are also radically affected with a failure rate of 8.4% (a surprising finding in the table is that 40.5% of Large banks between $2 billion and $10 billion asset-size will be marginally above the "Needs to Improve" rating).

The largest banks of all, $10 billion and over also will be significantly and adversely affected with failure rates of 4.7% (more than 4 times the historical record), but less radically than the two smaller groups.

Why would the Intermediate and smaller large banks suffer much more than the largest banks?

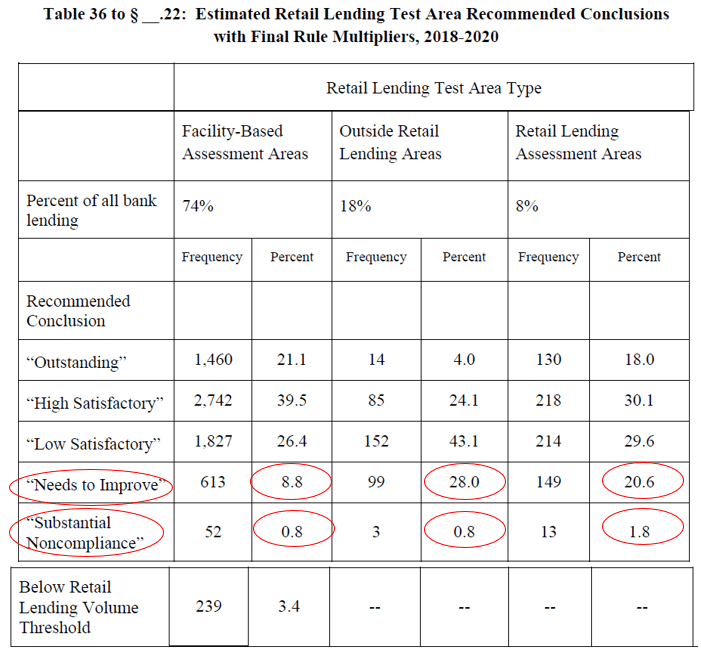

The answer may be found in the 2 new Assessment Areas that are outside the traditional Facility-based Assessment Area ("FBAA").

Table 36 shows the failure rates in the ORLAs (28.8%) and the RLAAs (22.4%) are many times higher than in the FBAAs (although at 9.6%, even the FBAA failure rate is historically high). So the regulators themselves anticipate much higher CRA exam failure rates in the new Assessment Areas mandated by the new Rule.

Intermediate banks that would be evaluated in their Outside Retail Lending Area ("ORLA") if they extend >50% of their product line loans outside their FBAA are likely to be at a much greater disadvantage than large banks that may maintain LPO's in the RLAAs and the ORLAs. The largest banks also are likely to have fewer RLAAs and smaller ORLAs (because they will have many more FBAAs and RLAAs). The bigger the bank the less adverse the consequences of the new Rule, although to be sure about it, even the largest banks are likely to experience quadruple the CRA exam failure rate than has been their experience.

Another hidden surprise - It's worse than it Appears!

Table 36 above also contains another very surprising and interesting statistic: 3.4% of the banks fall below the "Retail Lending Volume Threshold". These banks are highly likely to have either a "Needs to Improve" or "Substantial Noncompliance" rating because they are not extending enough credit within their FBAA. This means the CRA exam failure rate is likely to be 13.0% rather than the 9.6% depicted in the table!

So the magnitude of the damage as presented by the regulators themselves may be far worse than appears at first blush.

New CRA Rule webinar series to be broadcast

GeoDataVision knows that the new Rule is so radical and complex, a single 90-minute webinar will never be enough to communicate the far-reaching implications for CRA tests, performance standards, and performance ratings. GeoDataVision is planning to broadcast not 1 webinar but a series of webinars to help banks understand the new regulation and how it will affect them. Each webinar will focus on different aspects of the new rule.

Some topics to be addressed include:

- Key concepts in the new rule

- The Big Picture

- The Little Details (the devil really is in the details)

- How the Assessment Areas are configured

- The

complicatedconvoluted Retail Lending Tests in-depth including the Retail Lending Volume Screen Test, the Borrower and Geographic Distribution Test, multipliers, calibrated benchmarks, supporting conclusions, scoring, etc., - The Community Development Financing Test

Let us know if you are interested in these webinars if you have not already done so.