Support Services

CRA Program Template

The starting place for building a professional CRA Program includes:

- CRA Policy

- CRA Procedures

- CRA Data Entry Guide

- CRA Audit Checklist

- CRA Committee Agenda

- Documents and Worksheets

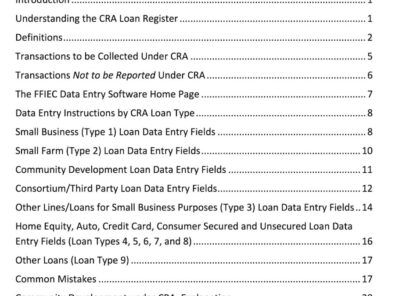

CRA and HMDA Data Entry Guides

“Data Integrity” is critical for measuring and managing compliance and performance responsibilities. Data Entry Guides are essential tools to assure the consistent and correct coding of HMDA and CRA records.GeoDataVision Data Entry Guides are user-friendly and kept up to date with regulatory change.

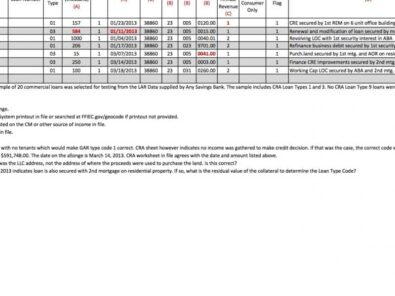

Data Scrubs

Reports include an Excel spreadsheet documenting the HMDA and CRA files selected for testing and the results of the comparison of the application/file information to the LAR and Microdata file; each Excel spreadsheet will include a legend to reference the source document used to perform the review. Also, a sample of all source documents from one loan file used to review a LAR entry.

Geocoding Records

Banks supply records with acceptable street, city, state, and zip code addresses for which we provide completed geocoding. Normal acceptance tolerance is 95%. Additional manual searches for more completeness can be done at additional charges.

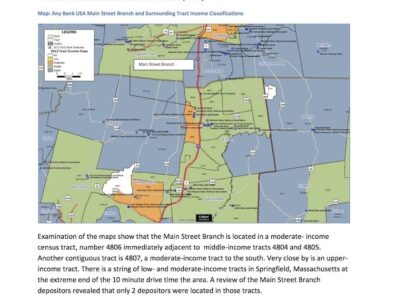

Branch Closing Community Impact Analysis Reports

GeoDataVision will assess the “Community Impact” and effects on deposit customers of the potential closing of a bank branch. Regulations mandate that a bank must submit “statistical or other information in support of the reasons consistent with the institution’s written policy for branch office closings”. Our reports cover important considerations in the process and supply a full written report with observations and conclusions.

Community Needs Assessment Reports

A Community Needs Assessment is a market study conducted to help a bank identify and understand the need for financial services and community development within its Assessment Area. While not required by regulation, such an analysis will provide the bank with “performance context” which is the basis for establishing “performance standards”. Also, such a Report can be used and relied on by the bank when assessing its Community Development Needs.

Process & Procedures Review

The starting place for building a professional CRA Program includes:

- CRA Policy

- CRA Procedures

- CRA Data Entry Guide

- CRA Audit Checklist

- CRA Committee Agenda

- Documents and Worksheets

Webinars

GeoDataVision Webinars are recognized as some of the finest presentations available, for information to help banks meet their “compliance and performance” responsibilities. The experts that present the materials are some of the finest in the country. The topics covered include CRA, Fair Lending, HMDA, Exam Prep, and more. Available live and recorded.

© copyright 2022. All RIghts Reserved

© copyright 2024. All Rights Reserved