The recent Supreme Court ruling that upheld the constitutionality of the Consumer Financial Protection Bureau’s funding resulted in the Bureau announcing the new effective dates for banks to begin collecting their CRA reportable data under the provisions of Section 1071 of Dodd Frank. The new dates, which have been extended by 290 days as prescribed by court injunction, are similar to the original odd compliance dates in that they begin in the middle of the year rather than the beginning of the year. This is particularly puzzling because the primary purpose of Section 1071 data is to provide data for regulators to use for CRA evaluations. But CRA evaluations are not done for partial year performance. Typically, they are done based on a calendar year basis. In fact, under the new CRA, exams will cover multiple calendar years simultaneously. So, the partial year data initially scheduled to be collected and then filed under 1071 will be worthless for CRA evaluations for data pertaining to 2025 and 2026.

Oh, and did I mention that dual reporting will be required for small business loans under CRA reporting requirements and under Section 1071 simultaneously? That’s because the Agencies will need usable data for CRA examinations.

But wait, there’s more. The definition of a small business loan is very different under CRA and under Section 1071. So, there’s plenty of room for confusion regarding the small business loans themselves for banks that will be reporting small business loans under both the current CRA definition and the new 1071 definition.

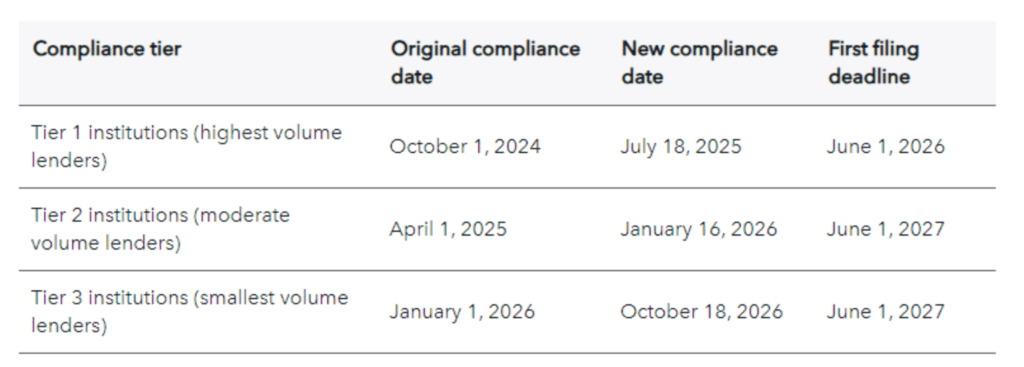

What is the new schedule for data collection to commence? The schedule as posted by the CFPB is below.

Lenders in every compliance Tier (based on the volume of reportable loans) will begin collecting and compiling the mandated small business loan data, not only in the middle of the year, but also in the middle of a month. Tier 1 will begin data collection on July 18, 2025. Tier 2 will begin collecting data on January 16, 2026, and Tier 3 on October 18, 2026.

This means that section 1071 data for the years 2025 and 2026 will not be complete annual data and therefore not usable for compliance and examination purposes. It also means that Section 1071 reporters that are large banks under CRA will need to report their small business lending activity under both the CRA rule and under the Section 1071 mandate as well for the years 2025 and 2026. This will be necessary because the prudential bank regulators will need complete calendar year data for compliance examinations.

Adding to the potential confusion is that lenders reporting under both the CRA rule and Section 1071 will be reporting on small business lending based on different definitions of what qualifies as a small business loan. Under CRA a small business loan is a loan of $1 million or less for a business purpose. But under Section 1071 a small business loan is not limited by the size of the loan. It is limited by the size of the business defined by gross annual revenues. Some lenders will be required to report small business loans with two different definitions (not to mention entirely different fields of corollary data).

So, it appears that many lenders will be reporting data for 2025 and 2026 (1) that is not usable, (2) that will involve double data collection and reporting and (3) that will use different definitions of what constitutes a small business loan.

What is the point of imposing this data collection schedule for worthless data (for CRA performance evaluation purposes) at considerable expense to reporters and likely will cause considerable confusion? We suggest that the Bureau reconsider the implementation of the data collection schedule under Section 1071 and mandate a more practical timetable that will make reported data immediately useful, eliminate duplicate reporting with different small business definitions, and save reporters money.