In the first 3 articles in this series (1, 2, 3), we identified fatal flaws in the 2023 CRA rule. In Parts 4a – 4c we propose the regulators consider potential improvements to the rule when they publish the Notice of Proposed Rulemaking regarding the repeal of the 2023 CRA rule.

Adopt a Simplified Version of the Retail Lending Test Calibrated Benchmarks

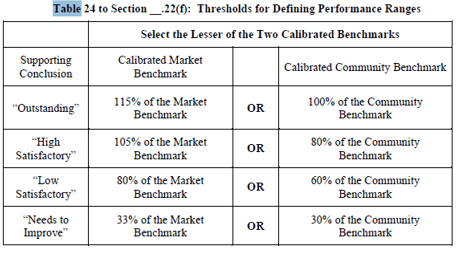

One of the good ideas in the 2023 CRA rule was to adopt a performance rating system with scores for each level performance predicated on comparisons to “market” and “community” benchmarks. As adopted within the 2023 rule there are too many data manipulations to be practical. But if the scoring system were to be based on “multipliers” as defined in the 2023 rule and limited to the “geographic” and “community” benchmarks, without the convoluted weightings for each result a more pragmatic scoring system is possible.

The table below (that we excerpted from the 2023 rule) for the first time since the 1995 rule was adopted shows references to Retail Lending Test performance benchmarks that allow a bank to compute its “Supporting Conclusion” (i.e., performance “rating”) for each of the “geographic” and “borrower” distribution tests. We strongly recommend that the agencies incorporate this concept when they publish the NPR to repeal the 2023 rule.

Substantial non-compliance would be anything less than the “Needs to Improve” benchmarks in Table 24 above.

It has never been clear how much lending a bank had to do to qualify for at least a “satisfactory” or other performance rating under the legacy CRA. Adopting a modified version of the “conclusions” tables in the 2023 CRA rule would clarify a performance rating system that has been opaque for far too long.

Multifamily mortgages should be isolated and evaluated in Urban Communities

Multifamily apartments are a major need for urban areas. Under the legacy CRA those mortgages are aggregated but not isolated in the HMDA data. In many communities, particularly cities where the poor and minority populations tend to be concentrated, multifamily housing comprises the majority of housing units. For example, in New York City multifamily housing accounts for more than 61% of all housing. In assessment areas where multifamily housing accounts for the majority of housing multifamily mortgage lending should be isolated as a component under the Lending Test.

Moreover, the number of apartments and the count of affordable units financed by each loan should be captured. As reported by the CFPB in the annual HMDA market data, these numbers are disguised and impossible to use so the Bureau would have to change its disclosure of that data. The Bureau has never really explained why it disguises that data. But no one can argue that it would be very valuable performance context data for CRA and Fair Lending purposes.

Include “renewed” Asset-Based commercial lending to small businesses

CRA evaluates a bank's performance in meeting the credit needs of its communities. A very important and widespread form of financing for the small business community is “asset-based financing”. However, much of that lending is not included in the reported small business lending because technically, most of that lending does not meet the definition of a “renewal” as defined in the CRA.

Typically, banks extend asset-based financing in the form of revolving lines of credit evidenced by demand notes. This is necessary to protect the “continuity” of the bank’s security interest. If a bank were to “refinance” the line annually by issuing new notes any intervening liens could supersede the bank’s security interest and jeopardize the value of the collateral. However, under CRA, “renewals” require an extension of the maturity date of the underlying note and a demand note is callable on demand so extending the maturity date is not possible. Consequently, the annual renewals of secured lines of credit don’t count in reported small business lending.

This means that reported small business lending understates the community’s need for that form of business lending. It also shortchanges banks that do extend that form of lending by denying them CRA credit for all those loans. We’ve seen situations in which banks engaged in similar volumes of lending to small businesses report substantially different numbers. The difference was caused by one bank extending traditional lines of credit renewed and reported annually and the other bank engaged in asset-based lines of credit that are renewed and not reported annually.

It’s time the enforcement of the CRA catches up to modern finance and recognizes a widespread and important form of financing for the small business community. In its 2020 CRA rule, the OCC adopted this approach, but the agency then reverted back to the 1995 rule thereby rescinding its acceptance of the renewals of lines of credit evidenced by demand notes as reportable under the CRA. The fact that the OCC in its 2020 rule had accepted “renewed” asset-based lines of credit indicates that the agency acknowledged the validity of reporting the renewal of asset-based financing.

The potential repeal of the 2023 CRA is a great opportunity to improve the legacy rule. If the regulators adopt this approach, it will demonstrate that the agencies want to improve the regulation, not destroy it.

To be Continued