Most of the articles published about the new CRA rule have repeated the party line – that the new rule “modernizes” the Regulation, that it will make CRA exams more objective and CRA ratings more consistent, etc. But the new CRA has a very serious, if not a fatal flaw, that will be devastating to the banking industry and perhaps be the legal undoing of the new regulation. What I am referring to are the new CRA assessment areas, what the regulation calls the “Retail Lending Assessment Area” and the “Outside Retail Lending Area”. These 2 new types of assessment areas raise serious legal questions and, even if they should survive a court challenge, their implementation will undermine the accuracy and validity of many CRA examination results thereby contradicting one of the major intentions of the new regulation.

First, regarding the legal issue. Many commenters to the Notice of Proposed Rulemaking in 2022 submitted comments raising the legal questionability of evaluating CRA performance in areas where banks don’t maintain deposit-taking facilities. In fact, the Bank Policy Institute, among others, cited specific legal objections to the two new types of Assessment Areas, claiming that the statute implicitly intended that the CRA was limited to communities where a bank maintained deposit-taking branches and ATMs.

The agencies in the preamble to the new CRA recognize these objections and rebuff them claiming that the Community Reinvestment Act is vague about the meaning of “communities” stating, “the references to a bank’s local communities in the congressional findings and purpose of the statute do not define what geographic areas constitute a bank’s local communities.” But that very argument is an admission that there are legal grounds for contesting the agencies' interpretation.

And where the agencies are really vulnerable is that they themselves since 1977 have interpreted the statute to mean “local communities” must incorporate only areas where a bank maintains its deposit-taking facilities. It was an interpretation that allowed for no other definition of assessment areas that didn’t have deposit-taking facilities. For 46 years of CRA enforcement the agencies have by their own interpretation expressly insisted that banks were not allowed to delineate a CRA assessment area that did not include at least one deposit-taking facility. There was no ambiguity or allowance for a different understanding.

The agencies’ 46-year insistence that a CRA assessment must include a deposit-taking facility has caused problems for banks that have used Loan Production Offices (“LPOs”) to market loans beyond their assessment area borders for many years. In any number of cases, the success of those LPOs has caused problems for banks under the “CRA Assessment Area Ratio” test used by the Agencies to determine if a bank’s lending volume in its local communities is adequate. The agencies' interpretation and insistence that “local communities” meant where a bank maintains its deposit-taking branches gave banks with a successful LPO no option but to deal with that interpretation for decades. This in our experience is a far more serious problem for CRA assessment areas than the advent of the Internet and could have been resolved with a simple alternative to the Assessment Area Ratio Test.

Now the agencies claim their 46-year interpretation doesn’t apply and are substituting a new interpretation that is a complete 180-degree reversal of nearly 50 years of regulatory enforcement. During that time no one, no lawmaker or bank, contested the agencies’ insistence that a CRA assessment area must contain a bank’s deposit facility. If that interpretation were incorrect, you would think that lawmakers themselves would have acted to correct the regulatory interpretation, but they didn’t. The Agencies complete reversal of their 46-year interpretation is tantamount to regulators not interpreting law but making law. After nearly a half century of enforcement do regulators have the authority to contradict their own interpretation of a law?

Finally, the CRA History page on the FRB website FRB CRA History as of December 2, 2023 describes the CRA history as, “Congress found that banks have a continuing and affirmative obligation to help meet the credit needs of their local communities, . . . This finding was based on preexisting chartering laws that require banks to demonstrate that their deposit taking facilities serve the convenience and need of their communities, which include credit and deposit services.” Clearly, even after the new CRA was approved by the Agencies, the FRB continues to acknowledge that the history of “local communities” as contained in the original legislation was tied to the presence of “deposit taking facilities.”

But even if the authority of the regulators to change the definition of a CRA assessment area is challenged and the regulators' interpretation upheld, there is another substantial flaw in the new assessment areas that should invalidate their application. What I am referring to is very misleading performance evaluations that will be created by the radically new assessment areas as the new rule says they will apply.

With respect to CRA evaluations (and fair lending exams too) judgment about performance is informed by what the regulation calls “performance context”, the unique credit market and demographics of the communities as they are defined. Performance standards are derived from and driven by performance context. Any change to an assessment area will change not only a bank’s performance but also the standards used by regulators to judge that performance. It is critical therefore that assessment areas be realistic and not arbitrary. But the application of the new assessment areas is completely arbitrary.

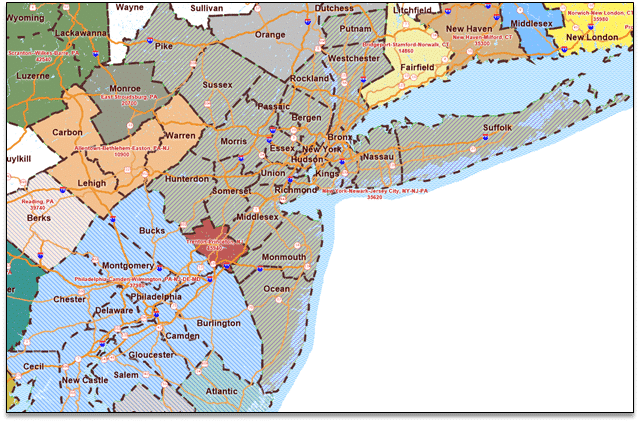

The new rule mandates that a “Retail Lending Assessment Area” will be a market where a bank originates or purchases 150 closed-end mortgages or 400 small business loans and must be no less than an entire MSA (or statewide non-MSA). So, the performance of a bank that extends 150 closed-end mortgages in the NY – Newark -Jersey City MSA that includes 23 counties, and 4,930 tracts will be judged based on standards derived from a “local community” that would be impossibly large to serve for all but the mega banks. As a consequence, the performance scores, conclusions, and ratings in that assessment area for that bank will not only be meaningless, but potentially very misleading. This is entirely contrary to the fundamental purpose of the CRA.

And there is another major problem with the concept as applied in the new Rule. Although the regulators boast that the new rule employs “tailored” standards they make no adjustments to the performance standards that recognize the serious competitive disadvantages of banks that may have a Retail Lending Assessment Area with their nearest facility a thousand or more miles removed from the RLAA. No fair-minded approach would dictate unfair and unrealistic performance standards.

Now regulators may respond to this criticism by saying these issues are performance context factors that examiners can consider when evaluating a bank’s performance in a RLAA. But I respond that what’s the point of invoking arbitrary and unrealistic performance standards that will create performance results that immediately put a bank in a defensive position, needing to count on the subjective judgment of examiners to disqualify the “objective” performance measurements rendered by an unrealistically defined assessment area?

The Retail Lending Assessment Areas are a very problematic concept, but the Outside Retail Lending Area (“ORLA”) concept is awful and damaging in the extreme, and by no definition can be justified as “local communities” served by a bank (this may be one of the best legal arguments against the new rule). As described in the new Rule, an ORLA is anywhere in the entire United States outside the Facility-based and Retail Lending Assessment Areas where a bank extends any “major product line” loans. What this means is that a Maine-based bank that extends a single closed-end mortgage in LA county will have that loan included in the CRA performance evaluation for its ORLA “component geographic area”. As defined in the new rule the ORLA can include dozens and potentially hundreds of “component geographic areas” in the 393 MSAs and 50 statewide-non-MSAs in the USA and Puerto Rico. There is no way this can be interpreted as “local communities” and as a practical and meaningful performance rating system. In fact, what’s the point of including markets where a bank may have minimal lending activity. The new rule does not specify any minimum volume threshold for the “component geographic areas”. It’s as if the regulators are trying to measure how many loans a banker can make on the head of a pin.

The new CRA rule is legally questionable, impractical, needlessly complex with arbitrary markets and a potentially seriously misleading performance rating system predicated on inflexible and unrealistic markets. It should be rescinded and rethought. And the banking community should certainly challenge the rule. As a CRA practitioner for 30 years I know the real tragedy is that the “old” CRA could have been dramatically improved with only minor modifications

Have you reviewed your Assessment Area lately? Check out GeoDataVision's "CRA Assessment Area Tuneup" using live dynamic online mapping. It's sophisticated, but doesn't require sophisticated mapping skills. It's visual and dynamic - live maps that allow you to test"what if" scenarios to see how different assessment area configurations affect your performance and regulators expectations.

Call 203-907-7497 or email Josh at Josh@Geodatavision.com