In my previous email I explained the devastating impact of the new CRA Rule on the percentage of banks receiving a less than satisfactory CRA Performance Rating. The data in Table 32 within the new Rule demonstrate that if the Rule had been applied from 2018-2020 there would be nearly a 900% increase in the percentage of large and intermediate banks that would receive a less than satisfactory rating on the Retail Lending Test. And, no matter how well a bank performs on the rest of its CRA exam, the regulation requires a bank to get at least a "satisfactory" performance rating on the Retail Lending Test in order to attain a "satisfactory" or "outstanding" performance rating overall. So passing the Retail Lending Test is absolutely a must!

What is in the new Rule that would cause such a dramatic increase in the percentage of banks that would fail their CRA exams?

There are likely at least 2 reasons that appear to be the underlying cause of the drastic impact on CRA performance ratings and there is explicit evidence that proves more difficult performance standards were deliberately inserted into the new Rule.

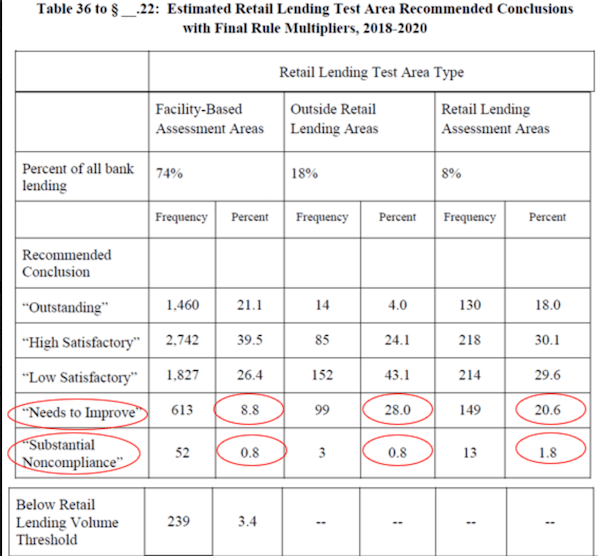

The advent of the new Retail lending Assessment Areas and Outside Retail Lending Areas are definitely one big factor. This is demonstrated by table 36 in the new Rule which breaks out the "Estimated Retail Lending Test Area Recommended Conclusions" by Assessment Area type as seen below. The numbers are shocking!

The Table reveals that the new Assessment Areas are a big factor in the stunning increase in CRA exam failure rates

The table is organized to distinguish Retail Lending Test performance ratings by each type of Assessment Area. The results clearly show that "Needs to Improve" and "Substantial Noncompliance" ratings apply to a stunning percentage of banks lending in the Retail Lending Areas ("RLAAs") and the Outside Retail Lending Areas ("ORLAs").

In the Retail Lending Assessment Areas 22.4% (20.6% + 1.8%) of large and intermediate banks would fail the test. In the Outside Retail Lending Areas, a stunning 28.8% (28.0% + .08%) of the banks in the study would fail their CRA exam (keep in mind that for the last 20 years the failure rate has been around 1.2%). But even in the traditional Facility-based Assessment Areas the failure rate under the new CRA Rule will be history of high, at 9.6% as indicated by the table published by the regulatory agencies in the new Rule.

It is no surprise that banks will not perform as well in markets outside their Facility-based communities because those banks are at a big competitive disadvantage against local bankers and local lenders of all types who know their communities. We had suggested in our comments for the CRA NPR last year that the Agencies should adjust the benchmarks for out-of-the-area lenders, especially when it comes to the Outside Retail Lending Areas.

The ORLAs cover any geographic area in the entire United States (excluding the Facility-based and the Retail Lending Assessment Areas) where a lender originated or purchased a single product line loan that qualifies as a "major product line" loan in the ORLA. Moreover, the smallest geographic unit in the ORLA is an entire MSA, MD, or statewide-area counties. To say that comparing lenders with no branches and who may have originated only 1 or 2 product line loans to locally-based lenders with branches in an entire MSA is fair and reasonable is absurd.

How can any comparison of lending in those communities to market and community benchmarks that may largely be based on the activity of local lenders be meaningful for lenders who may not have any local resources (the out of market lender may even have purchased their loans and not originated them)?

Clearly, the new Rule is arbitrary when setting benchmarks that don't distinguish local lenders in the community to lenders who may not have anyone or any facilities in the market. The regulators may describe the new rule as a "tailored approach", but it is definitely not tailored to accommodate an uneven competitor playing field!

The new CRA Rule has deliberately "raised the bar"

But Table 36 also reveals another concern and hints at the underlying cause.

What I am referring to are the less than satisfactory performance ratings in the Facility-based Assessment Areas. At 9.6%, those failure rates are 8 times the historical average! Clearly, the competitive disadvantages of lenders with no branches being compared to lenders who do have branches is not an excuse in this case.

So what may explain the explosion of non-performing banks in their own backyard where they have branches and personnel?

There is only one answer and that is the standards have been deliberately changed and inflated by the regulators.

Since 1995 regulators have been evaluating bank performance on similar, if not identical metrics and benchmarks contained in the new Rule. However, the regulators never announced any public "calibrated" benchmarks until now. But, the new Rule does explicitly identify "calibrated benchmarks". It's impossible to compare the publicly announced "calibrated" performance standards with the heretofor secret standards that have been in effect since 1995.

The record-breaking CRA exam failure rates in Facility-bases assessment areas as identified by the regulators in Table 36 for the exams conducted during 2018-2020 can be explained only by an increase in the performance standards. How else can you explain the whopping increase in expected CRA exam failure rates under identical circumstances during identical time periods? In fact there is evidence that making it more difficult to pass a CRA exam was intentional.

The Smoking Gun

It appears the standards have been rigged by the regulators in response to political criticism that the historically low CRA exam failure rate proves the regulators were guilty of "grade inflation". Any doubt of that the intention is to raise the bar about CRA performance standards is erased by FDIC Chair Martin Gruenberg's comments in front of the National Community Reinvestment Coalition in June 2022 in which he admitted that the new Rule would, "raise the bar for CRA performance on the retail lending test."

The expected CRA exam failure rates are absolutely devastating and a warning to all banks that passing a CRA exam is going to be far more challenging than ever before.

Our next email newsletter will address which banks get hit the hardest by the new CRA Rule.