With all the news stories circulating about the new CRA Rule, it's surprising that not one article has addressed the topic that should be the biggest story of all - the catastrophic implications for banks!

What I am referring to is the dramatic increase in the CRA exam failure rate that can be expected as explained by the regulators themselves in the 1,494-page document.

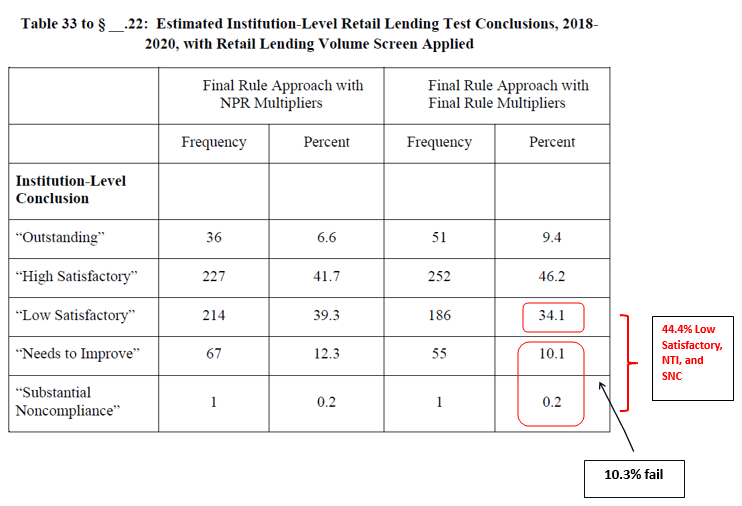

Buried deep within the document are a series of tables developed by the regulators that display the estimated CRA exam failure rate had the new Rule been in effect for the years 2018-2020. The table below shows the results, and they are shocking.

Historically, the CRA examination failure rate has been around 1.2%. But Table 32 shows the estimated frequency rates for the 5 different performance ratings under the Retail Lending Test and it reveals that, for the banks included in the analysis, at the Institution-Level the CRA exam failure rate would be 10.3% - almost a 900% increase in CRA bank failure if the new Rule had been in effect for the 3 years in the analysis.

Even more shocking is the percentage of banks that get the lowest satisfactory grade, just above "Needs to Improve", 34.1%! More than a third of all the banks in the study would marginally pass their Retail Lending Test.

Combined, the percentage of banks who fail their CRA exam under the new regimen and those who marginally passed, total 44.3%

Some people might be tempted to say, "But that's the impact only on the Retail Lending Test results." And to that I respond, "Yes, but a Large bank or Intermediate bank cannot pass a CRA exam if it doesn't get at least a low satisfactory on the Retail Lending Test."

So no matter how good a Large or Intermediate bank's CRA performance is on the other bank Performance tests they will get a "composite" (i.e., institutional level) performance rating of "Needs to Improve" if they don't get at least a "low satisfactory" rating on the Retail Lending Test. So a less than satisfactory performance rating on the Retail Lending Test at the institution level guarantees a less than satisfactory composite performance rating.

What is the underlying cause of the almost 9-fold increase in the percent of banks getting less than a satisfactory CRA performance conclusion? The answer to that will be in our next email newsletter.