CRA (Community Reinvestment Act)

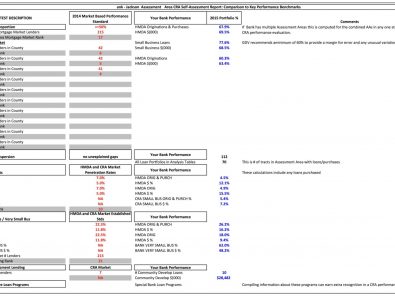

Reports include: Self-Assessment; Market Data Analysis; Performance Context information; Loan Distribution organized for Lending Test Analysis; Maps of Lending and Demographics; Professional Consulting on Reports.

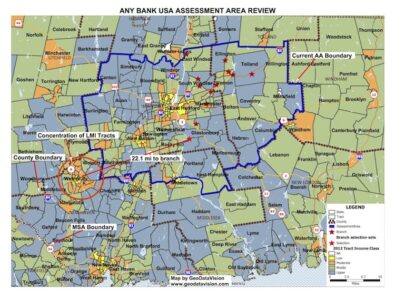

Includes Loan Distribution Maps; Live Mapping Session; Expert Analysis; Drive –Time and Distance Analysis for Branches; Professional Consulting; Taped Session; Final AA Map(s).

Market Data extracted from the latest FFIEC National Reported HMDA, CRA, and Community Development. These Reports set the standards by which a bank will be examined. They expose the “performance context” information that can be supportive of a bank’s performance results. It is the information examiners will use to evaluate you.

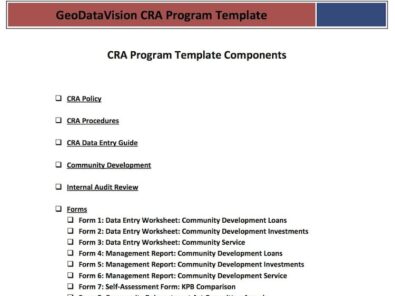

CRA Program Template

The starting place for building a professional CRA Program, it includes:

- CRA Policy

- CRA Procedures

- CRA Data Entry Guide

- CRA Audit Checklist

- CRA Committee Agenda

- Documents and Worksheets

CRA Training and Consulting

A GeoDataVision expert will work with you and your personnel in the areas of HMDA/CRA/Fair Lending/Community Development. These services can be provided via the web or onsite, in person. In addition to hands on consulting and training, we also provide webinars (live and recorded) that are extremely useful in training your staff.

Data Scrubs

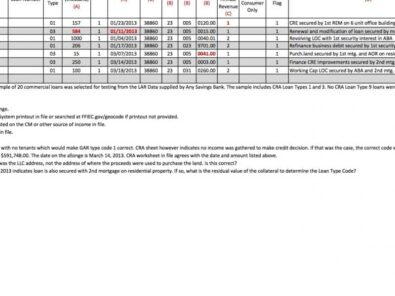

Reports include an Excel spreadsheet documenting the HMDA and CRA files selected for testing and the results of the comparison of the application/file information to the LAR and Microdata file; each Excel spreadsheet will include a legend to reference the source document used to perform the review. Also, a sample of all source documents from one loan file used to review a LAR entry.

© copyright 2024. All Rights Reserved