Climate Risk Assessments for banking purposes are in the early stages of development. No laws or regulations have been issued regarding the topic. Nonetheless, it is obvious that lawmakers and regulators are keenly intent on developing laws and regulations to require banks to develop climate-related risk assessments. The Chairperson of the Federal Reserve and various Federal Reserve governors along with the Acting Comptroller of the Currency have publicly announced their intention to develop regulations and models to measure and evaluate Climate-related risk exposures for banks.

On November 8, 2021, Acting Comptroller of the Currency, Michael Hsu, in a speech entitled, “Five Climate Questions Every Bank Board Should Ask”, identified the following five questions:

- “What is our overall exposure to climate change?”

- “Which counterparties, sectors, or locales warrant our heightened attention and focus?”

- “How exposed are we to a carbon tax?”

- “How vulnerable are our data centers and other critical services to extreme weather?”

- “What can we do to position ourselves to seize opportunities from climate change?”

The signs are there, but no laws and no regulations have been published yet. It’s clear that regulators expect banks to already be engaged in monitoring and assessing climate risk for their institutions. But with no laws and no regulations what’s a banker to do?

To begin with, while regulators have not yet issued specific quantifiable definitions of “climate risk”, it’s obvious that any Climate Risk definition would contain several important components: (1) climate hazards that are currently an immediate potential threat, (2) climate hazards that are not immediate but may become threats in the near future, and (3) climate-implicated threats related to specific industries, particularly the energy sector. Moreover, the threats may present themselves in terms of implications for bank facilities, credit-related risks (real estate secured loans for example), and climate effects on the communities served by a bank. Finally, climate risk may be in the form of ex ante and post ante analysis.

What may surprise some people is there currently are climate risk databases that are adaptable for banking purposes, particularly for imminent climate hazard threats. Various federal agencies, including FEMA, NOAA, the US Army Corps of Engineers, the USGS, the USDA, etc., have collected climate and natural hazards risk data that can be the foundation for intelligent and quantifiable climate risk assessments for banks.

With this data, maps and spreadsheets can be created that identify and display the distribution of climate-related risk as it exists today across geographic areas that can be correlated with bank markets and generate quantifiable measurements correlated with the level of risk.

This kind of analysis isn’t just for the larger banks and regulators will expect smaller institutions to monitor their risk as well. Today, the cost of data and mapping services are affordable for even community banks who can also seize the initiative and establish themselves as leaders. You don’t have to wait for the “big guys” to lead the way!

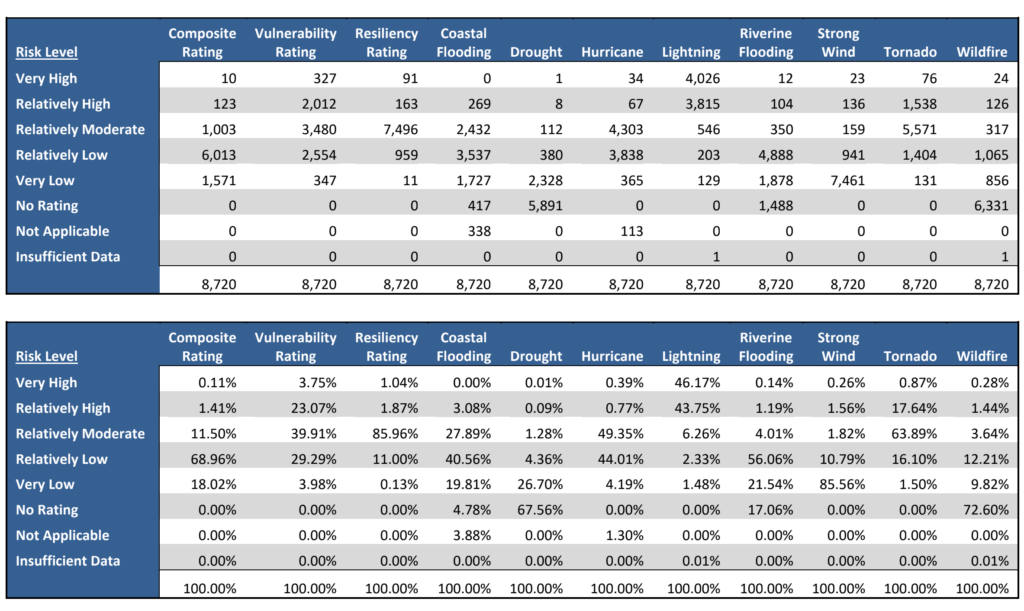

Below is a table of the climate risk exposure position of a bank that captures multiple types of climate-related risks matched against a loan portfolio.

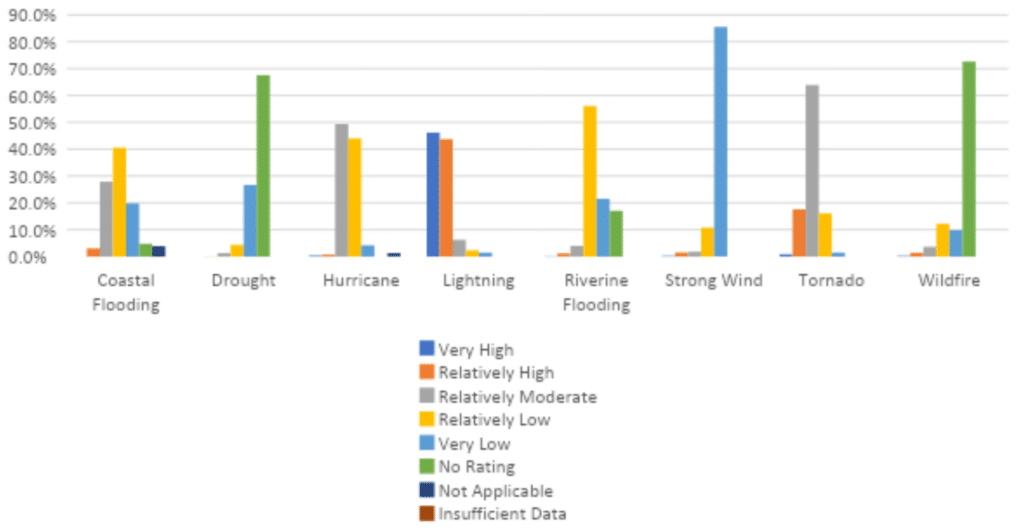

The comprehension of climate risk can be aided by converting the tabular data into graphs that reveal the dispersion of risk across different climate phenomena and risk rating levels.

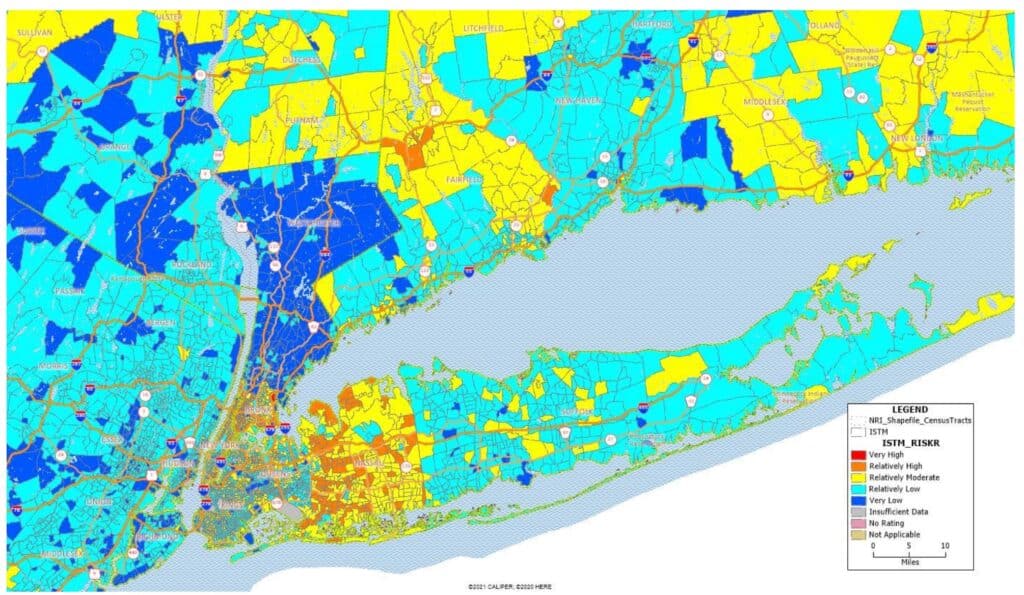

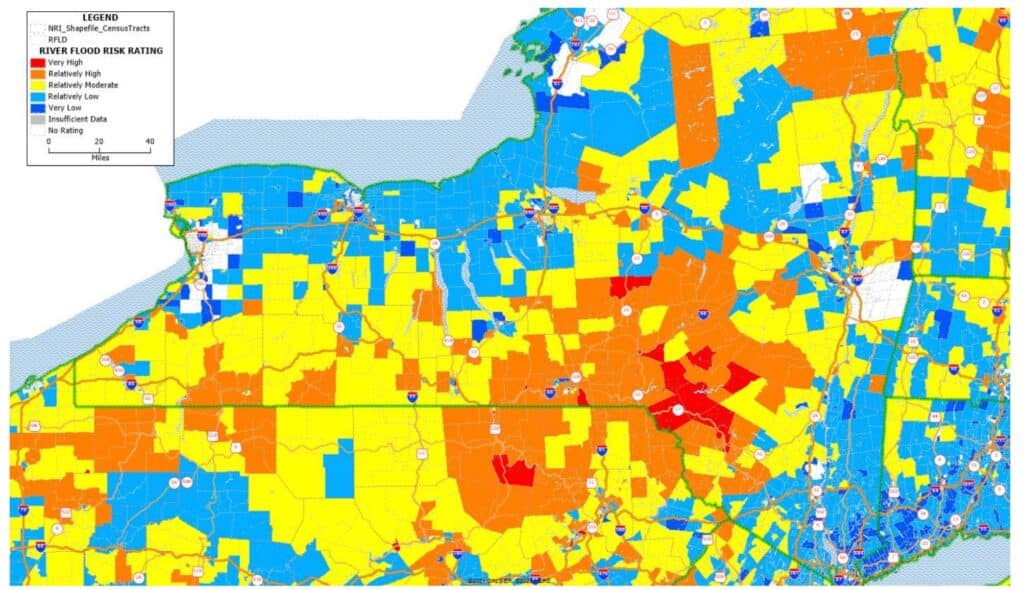

Even more exciting is this data can be imported into maps making possible the visualization of your climate risk as it is spread across the communities your bank serves. GIS technology is particularly effective for climate risk analysis because it allows the viewer to see climate risk across geographies and communities. For example, below are maps depicting the risk from ice storms in the NY and Long Island areas and river flood risk in NY state.

What may surprise bankers and regulators alike is that climate risk exposure for many different types of natural climate risk hazards can be very granular right down to the lowest geographic level applied to other regulatory risks, such as Fair Lending and CRA performance, making detailed analysis on a never before possible basis.The combination of available climate data and GIS technology makes possible in-depth quantitative analysis today. There really is no need to wait for bank regulators to precisely define climate risk assessment. In fact, the situation today presents bankers with a rare opportunity to lead the regulators on an important topic and thereby increase the likelihood that the regulations that will ultimately be adopted will be realistic and compatible with processes already established within the industry.

The Federal Reserve, FDIC, OCC and several state bank regulators, notably the New York State Department of Financial Services, are now expecting financial institutions to have in place systems that appropriately identify, measure, control, and monitor all of their material risks related to climate. GeoDataVision Climate Risk Meter™ Reports use sophisticated mapping technology combined with climate hazard data from the Federal Emergency Management Administration to pinpoint and measure financial institution climate risk exposures at the institution level down to each and every record.

Want to learn more about this new service based on leading edge technology for your institution?