Register for the webinar

Dear Banker,

Readers and reviewers of the 2022 joint CRA NPR issued by the bank regulators on May 5 may be overwhelmed by the long (679 pages) and complex proposed rule-making document. Just trying to grasp the proposal is a daunting task.

For sure, the NPR does contain some overwhelming changes including bank sizes, assessment area delineation rules, deposit reporting for very large banks, and the application of new tests. It takes a while to absorb the number and magnitude of the changes within the proposal.

But buried in the document are some tables developed by the regulators to estimate the impact on banks - and that's what ought to give bankers pause and sound the alarm bells. Surprisingly, not a single commentary focusing on this aspect of the proposal has been published as of the date of this e-newsletter.

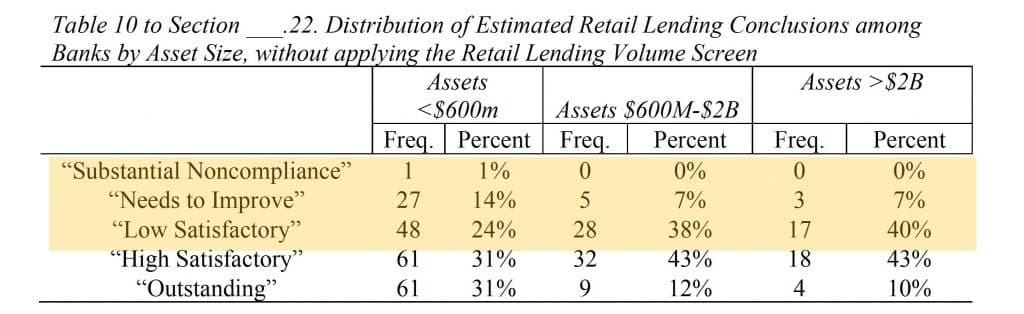

One of the tables depicts the "Distribution of Estimated Retail Lending Test Conclusions among Banks by Asset Size" and is based on banks that had a CRA examination that began in 2018 or 2019 and excluded Wholesale, Limited Purpose, and Strategic Plan banks.

The table above shows that 15% of banks below $600 million in asset size are estimated to fail under the proposed new Retail Lending Test. The Table also reveals the Agencies estimate that 7% of banks classified as "Intermediate Banks" and 7% of banks defined as "Large Banks" would receive less than Satisfactory "conclusions".

Even more alarming is the estimated number and percentage of banks that would earn a Low Satisfactory "conclusion": 24% for Small Banks, 38% for Intermediate Banks, and 40% for Large Banks. In other words, when "conclusions" are combined, 41% of the banks used by the Agencies for this table would either fail the test or be a hair's breadth above a less than satisfactory "conclusion"!

This observation is very important because, although the Retail Lending Test would account for only 45% of a bank's CRA composite performance rating, the proposed rule requires banks to attain at least a satisfactory rating on the Retail Lending test.

How significant are the foregoing observations?

Compare those statistics to the banks that received a less than satisfactory CRA PE during 2018 and 2019.

For banks evaluated by the Fed and the OCC, fewer than 1% received a less than satisfactory rating. While 1.7% of banks examined by the FDIC were rated as less than satisfactory.

In other words, by the regulators' own estimates, the NPR if adopted as proposed, will dramatically increase the relative percent of banks failing their CRA exams!

The comparisons are striking and should be frightening for banks.

Some observers might dismiss the observations based on the small number (314) of banks included by the Agencies in the table. But another table developed by the Agencies reinforces the concerns raised above.

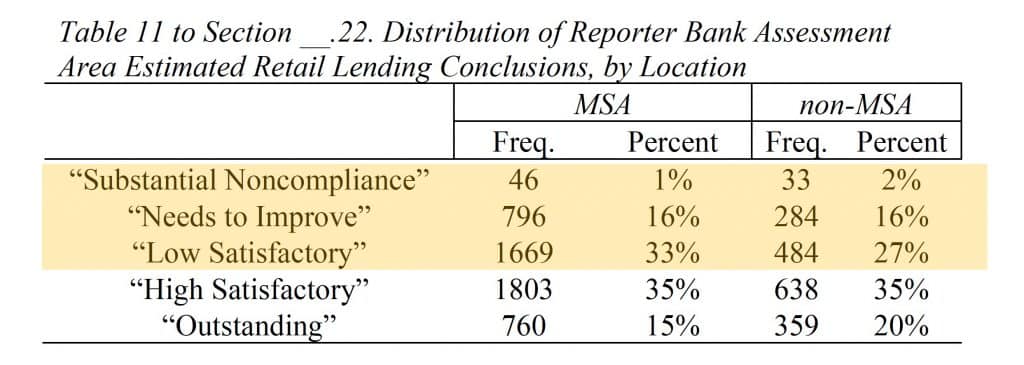

The Table below was extracted from the NPR and includes 606 banks that were both CRA and HMDA reporters and excluded wholesale, limited purpose, and strategic plan banks. In other words, the table contains virtually 100% of the banks that would be classified as Large Banks as well as a few Intermediate-size banks under the NPR (663 banks with assets of $600 million or more reported CRA data for 2020).

The foregoing table indicates that in 17% of the Facility-Based Assessment Areas within an MSA and 18% outside an MSA banks would receive either a "Needs to Improve" or "Substantial Noncompliance" conclusion! Then look at the percentages receiving a "Low Satisfactory" conclusion (33% for AA's in MSA's and 27% in non-MSA AA's) and let it sink in that in nearly 50% of those Assessment Areas banks either would receive a less than satisfactory rating or would be a hair's breadth above that rating!

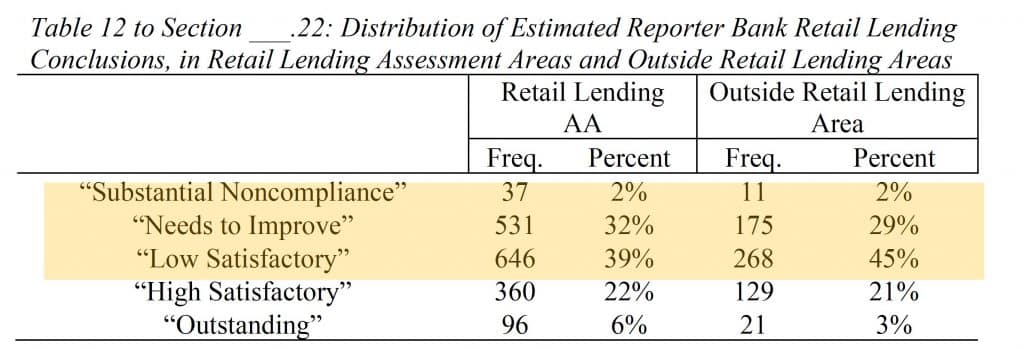

Finally, as if to emphasize the dramatic impact the new rule will have on Large Banks, the Agencies developed Table 12 which depicts Retail Lending Test Performance Ratings in "Retail lending AA's" and "Outside Retail Lending Areas". The Table includes 604 CRA and HMDA-reporting lenders (100% of "Large" Banks as well as several Intermediate Banks that voluntarily reported their CRA data).

The results in Table 12 ought to be alarming. The table reveals that in more than one-third (34%) of "Retail Assessment Areas" banks would receive less than a satisfactory "conclusion" and in "Outside Retail Lending Areas" almost one-third (31%) would get a "Needs to Improve" or "Substantial Noncompliance" "conclusion".

Also, as pointed out above, when banks receiving a "Low Satisfactory" conclusion are factored in, about 70% - 75% of the banks identifying Retail Lending AA's and Outside Retail Lending Areas will receive "Low Satisfactory", "Needs to Improve" or Substantial Noncompliance" Retail Lending Test "conclusions" for their activity in those areas.

This last table alone, calls into question the impact of evaluating a bank's performance in areas where it has no branches. The NPR does not call for any adjustments in the performance metrics to allow for the substantial competitive disadvantages for banks that will be compelled to match performance metrics largely driven by local lenders in areas where they (banks for which the market is outside their facility-based AA's) have no branches.

It's very clear, based on the regulators' own data, that the NPR contains some very alarming implications for banks and their CRA responsibilities. It's important that bankers understand the potential consequences if the NPR should pass as proposed and express their concerns before the August 5 comments deadline.